Accounting is the systematic recording and organizing of all the financial information of a company. This refers to the bookkeeping function of Accounting; where bookkeepers record accounts in journals and transferring it to a ledger. Accounting also has the reporting function where all the gathered financial information are used to create financial statements to analyze and understand the financial health and performance of the business. It’s pretty straightforward, almost all people can understand this definition at first look, but what confuses everybody is the concept of Debit and Credit. Now to set things clear, let’s define first debit and credit.

What is Debit and Credit?

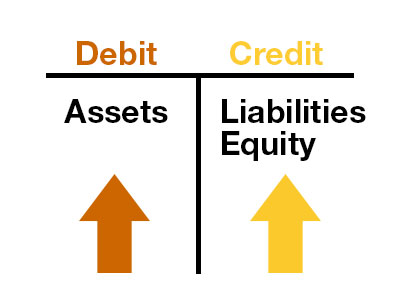

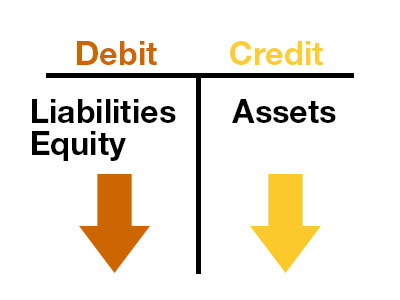

• Debit – is an Accounting entry that increases Assets and decreases Liabilities and Owner’s Equity.

• Credit – is an Accounting entry that decreases Assets and increases Liabilities and Owner’s Equity.

Why is it confusing?

Understanding Debit and Credit is counter intuitive. Forget all the things you know about the word Credit because we’re not talking about credit cards, debt, recognition, or acknowledgement of some sort. Treat this two words as if you’ve encountered them for the first time. This is what confuses and scares away people from learning accounting with no intention of going back. If you can take this concept in, you’re halfway to mastering Debit and Credit.

How can you understand it?

Debit and Credit is designed to represent the duality of a Single Transaction. To understand better, suppose your business received Cash for a Sale of Product. When you purchase something and pay for it, your Cash will decrease but does this mean your Sales will decrease also?

Next, you need to know the Basic Accounting equation.

Assets = Liabilities + Equity

Draw a vertical line where the equal sign stands so it would look like Assets are on the left and Liabilities and Equity are grouped on the right. Here’s the Golden Rule. Whenever you encounter a record that will increase an Asset Account you have to Debit it, and whenever you encounter a record that will increase a Liability or equity account you have to Credit it. Consequently, a transaction that will decrease an Asset Account should be Credited and a transaction that will Decrease a Liability or Equity Account should be debited. The only thing you need to now, is the transactions that fall into Assets, Liabilities, or Equity. You can refer to this Past Article for quick reference. “Bookkeeping Basics”

For example, if you received cash for a product or service, you’ll write debit Cash and Credit Sales. Why? Because receiving cash increases Assets and it also increases Sales which affects Equity. In short, you debit cash because it increase your asset and you credit Sales because it increases your Equity.

Conclusion

Debit and Credit is a very confusing theory to understand. So if you don’t get it right away, give yourself some break and go at it again. Accounting itself is simple. It has been in this world for 500 years and it might added to why is it confusing when modern people try to understand it. But just remember the Golden Rule and you’re all good.

TrendStatic Corporation is also an Accounting Training Provider located in Ortigas Centre, Pasig Philippines.

We are happy to meet with you for us to assess your company’s payroll requirements.

For more detailed information about this topic or you want assessment for your company, please feel free to contact us by filling up the blue form, and we will contact you as soon as we read your message.

Recommended Services for your company growth:

Accounting Services (Bookkeeping, Tax, FS Analysis, Business Process Review)

Business Consultancy and Corporate Services